“In wartime, truth is so precious that she should always be attended by a bodyguard of lies” Winston Churchill, British Statesman and Prime Minister

In the personal tragedies of war truth is often its first casualty. As we write this, we have limited reliable sources of information and so we try to piece together the pattern of events as we know them to inform us about possible outcomes.

Wars and their outcomes are rarely certain and inevitably they are accompanied by a significant amount of disinformation and uncertainty. Our aim is to present some analysis and relate it back to what we may be seeing as the economic fall out of current hostilities and the measures being taking to contain the aggression of Russia. It is difficult to present this dispassionately as we know there is an immense and unimaginable amount of human suffering and maybe significantly more before hostilities cease.

What do we know about the conflict?

The direct answer is very little for definite. However, it does seem unlikely that the Kremlin would have embarked on this momentous and history changing operation without anticipating an early conclusion. It seems they would have an assumption that the Ukrainian government would fold quickly through lack of popular support. They may have assumed the Ukrainian military would lay down their arms and allow Russian forces full access to occupy the country. A safe assumption would be that Russia would have intended they would have gained superiority over Ukrainian airspace very quickly. So far, two weeks into the conflict, none of this appears to have taken place. Russia doesn’t appear to have neutralized Ukraine’s air force, the government is still in place and seems to have increased its popular support. The Ukrainian military, meanwhile, is operational and appears sufficiently well organized to not only stand up to the Russian military but even push them back in certain locations. The result seems to be that Russia will increase lethal shelling and missile operations thereby increasing collateral damage dramatically and also the human tragedy of an increasing death toll of innocent civilians.

What has the western response been?

Military: NATO has increased its military resources along its eastern flank considerably. More personnel and equipment have been sent particularly to Poland and Estonia and presumably other locations. It appears the US may supply more F16 aircraft to Poland with the latter sending its ageing MiG fighters to Ukraine. The supply of weaponry to Ukraine from across the EU has increased significantly and, indeed, Germany has ended a 70-year ban on supplying military equipment to other countries and is now actively supplying Ukraine. Germany, meanwhile, has nearly doubled its defense budget to over 2% of GDP. A level no U.S. administration has been able to persuade them to do. Denmark, South Korea and Japan have also announced significant increases in defense spending.

NATO: There are now active discussions in Finland and Sweden of ending 70 years (Finland) of neutrality and Sweden over 100 years of neutrality in favor of joining NATO

Economic: This is where most of the actions from the west have taken place.

- Sanctions have been imposed and supported by many countries though with large economies such as China, India, UAE and even Brazil sitting on the sidelines. This means that Russian access to a wide range of western goods and technology will be either severely reduced or the supply chains will be much more complex, but probably not impossible. Costs for Russia will of course rise significantly.

- Restrictions to Russian institutions’ use of the SWIFT financial messaging system from March 12 will hamper Russia’s ability to receive payment for any exports and pay for imports. This, of course, also has implications for western financial institutions with debts outstanding in Russian companies and in Russian government bonds. Citigroup, for example, is known to have around $10 billion of loans to Russian entities which presumably will now be treated as bad debts.

- Freezing Russian assets held in banks outside Russia means the state will find it difficult to access its foreign exchange reserves. It is estimated that up to 70% of the Russian Central Bank reserves may now be unavailable to them. As a result, the only way for Russia to stem the fall in the ruble is to raise interest rates and since the start of open hostilities interest rates have been more than doubled to 25%.

- The Russian ruble has dropped precipitously, falling by more than a half relative to the U.S. dollar since the start of January. As well as meaning that any foreign goods will now cost significantly more where they can get them, this does also mean that Russia will get more rubles for its oil and natural gas exports and even more so given the sharp rise in oil and natural gas prices as a direct result of the war.

- Russian airlines and aircraft have effectively been banned from landing and over flying much of the world outside Russia, China, and India. Again, while inconvenient for most western nations, this will hamper Russia’s supply lines considerably.

- There are, however, considerable economic implications from the inevitable collapse of the Ukrainian economy. The country is, after all, the fifth largest producer of wheat globally and the likelihood is that most of this year’s production will be lost. Other crops such as barley, oats and even corn will also be affected. The impact is already being felt with the recent dramatic rise in grain prices. Interestingly, one of the main customers for Ukraine wheat is China.

- Ukraine is also a major supplier of components for the European motor industry. As a result, many auto companies have announced plant closures because of a lack of necessary supplies. This will inevitably cause stress in global supply chains as auto manufacturers affected will seek alternative supplies.

What does this mean for investment markets?

Amongst the human tragedy of war, it is always difficult to present a dispassionate view on capital markets. However, times of uncertainty are just when cool heads and rational judgement are needed.

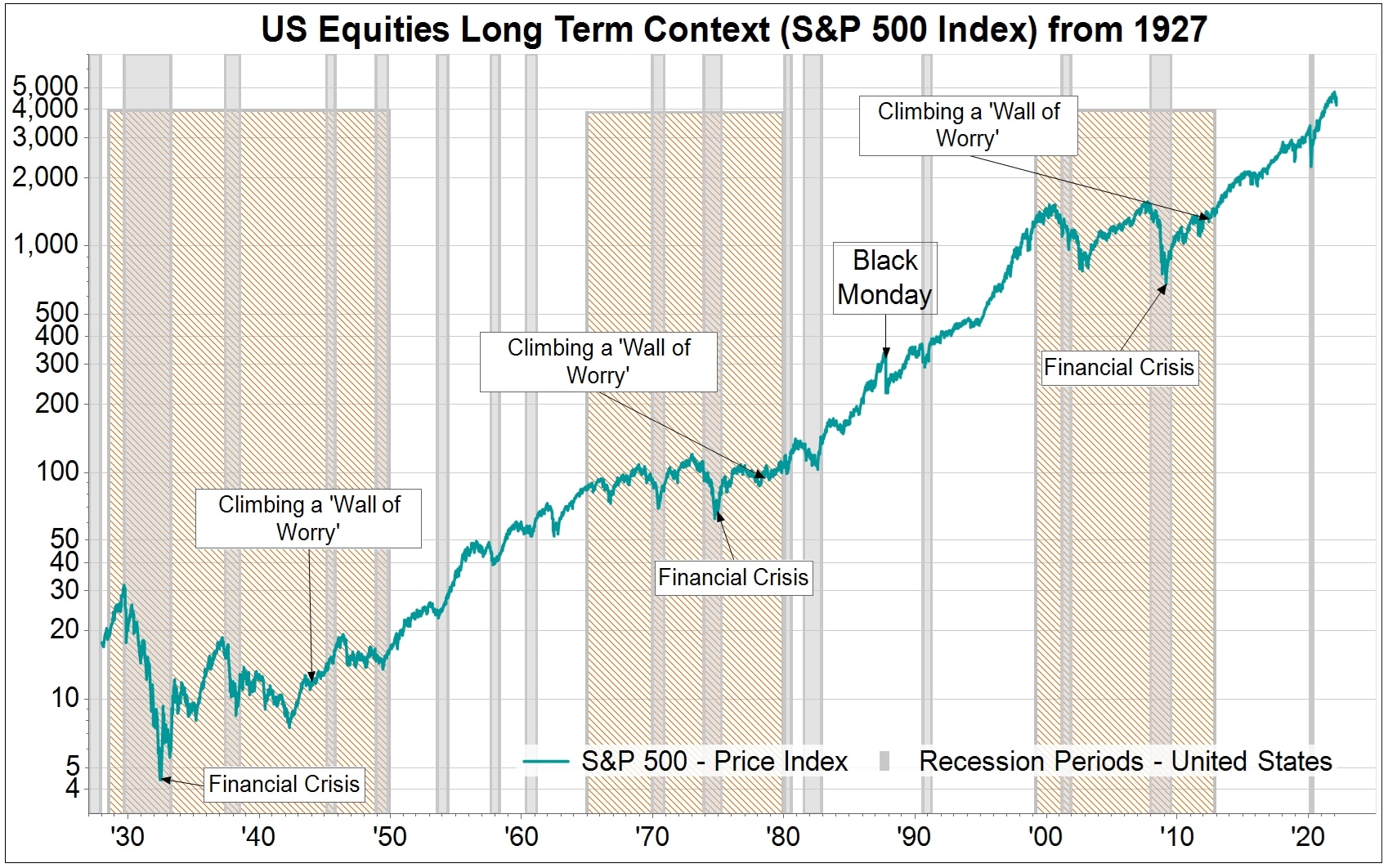

We know over the experience of many years that times of uncertainty are never good for investment markets and volatility increases significantly. This time is no exception. However, we also know from long term experience that it is just these periods of uncertainty that provide investment opportunity.

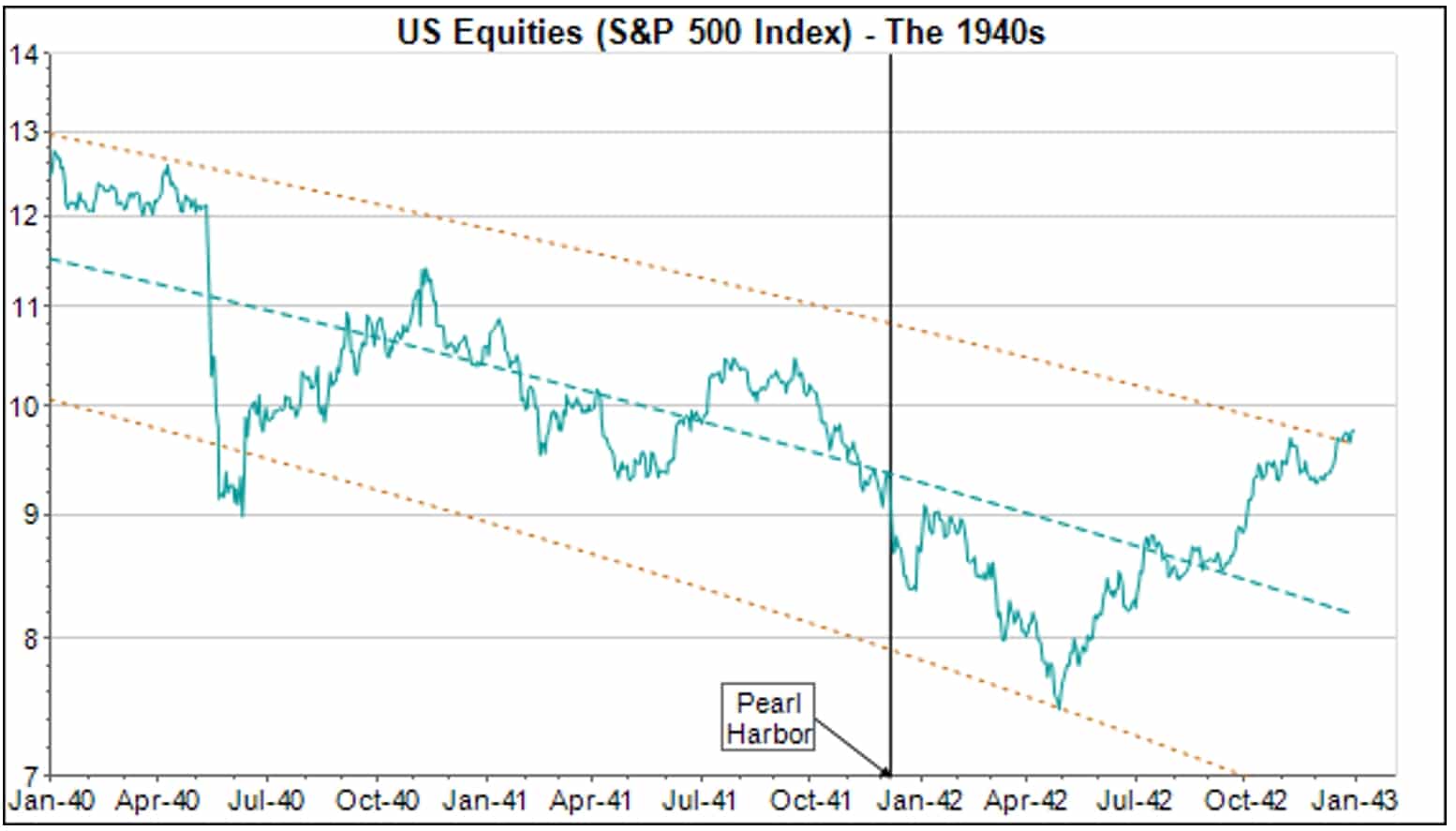

We can reflect on the experience of the many wars of the last hundred years and what we find is that the period of not knowing what a response to hostilities will be tends to provide the greatest uncertainty and hence market volatility. Often when a direction becomes clear, markets, especially equities, respond positively. For example, at the time of Pearl Harbor, much of the damage to the equity market was in the six months before the attack. Although the market declined further immediately, by the end of February 1942, a significant rebound was underway. Similar outcomes were apparent at the time of the Korean, Vietnam, Gulf and Afghanistan wars. This may seem both uncomfortable and unexpected, but it reflects the reality that economic growth tends to rise during periods of conflict given the increased stimulus from military spending.

The certainty during periods of extreme anxiety is that investors globally will seek safe havens for their money. We can already see this in the strength of the U.S. dollar and the demand for U.S. Treasuries. Gold has similarly strengthened, but many risks assets have fallen including equities and crypto currencies. European and Emerging market equities have been particularly weak. Interestingly, though, so far in March the drop in the U.S. equity market has taken the S&P 500 Index just to the bottom of the fall in January, losing 11% since the start of the year. While certainly uncomfortable, at this point we’ve just entered the “correction” territory marked by a 10% pullback from recent highs. Although we have not endured a market correction since the end of 2018, they’re not infrequent and tend to be short-term in duration.

In these times of uncertainty, our preferred approach to control overall portfolio volatility is to increase holdings of cash and cash like investments such as short-dated Treasury bonds when the opportunity presents itself. We often refer to this as the moat in a client’s portfolio, as it provides a margin of safety that prevents the untimely selling of positions during a market decline.

Further, we carefully assess each holding to determine if there is a direct exposure to losses produced by the exogenous event and make adjustments when necessary.

In addition to the disruption to markets that recent geo-political events have caused, we’re carefully considering how The Fed’s strategy to control inflation and ease back from the highly stimulative economic environment of the previous two years will be impacted.

The US economy continues to produce data evidencing its strength and resiliency. Unemployment rates are falling, corporate profits and future guidance remain robust, and capital goods orders point to unprecedented spending on increasing domestic capacity to produce.

The market is now trading on a multiple equal to that of late 2019 and early 2020. While not cheap by historical standards, much of the stimulus-induced froth has been removed. To many this is a welcome reversion that quells fears of a market bubble and creates the opportunity for investment into favored companies at more reasonable prices.

We understand that times of uncertainty, whether caused by war, disease, civil unrest, or financial crises, are troubling and anxiety inducing on many levels. At Renaissance, our role is to view these events through the lens of economic reality and likely impacts on your investments. We hope our vigilance in these matters brings you some peace of mind.

Trevor M. Forbes

President and Chief Investment Officer

Christopher A. Silipigno, ChFC ®

Chief Executive Officer and Managing Director

FactSet is the source of all graphs.