What is rotation risk?

Simply put, rotation risk is the chance that investments in one asset class or category within an asset class that were previously in favor, experiencing strong returns and price appreciation (gains), will become less favored and experience price depreciation (losses). This can happen rather quickly, leaving investors with an asset that lost much of the gains enjoyed when that asset was prized. Worse yet, rotations can create sizeable losses to those that bought the appreciating asset towards the end of its run-up in price.

The events of 2020, namely the Coronavirus and widespread economic upheaval caused by the pandemic, has created massive and record-breaking changes in portfolio holdings and fund flows. As investors have tried to properly position themselves to avoid deep losses and conversely profit from companies that stand to gain from what has commonly been referred to as “the new normal”, specific sectors of the market and asset classes have experienced outsized gains. Adding to the frenzy of buying in these favored stocks and asset classes, global economic stimulus has now reached over 30T or 35% of the world’s GDP. This has provided investors with plenty of liquidity to invest in these preferred areas, consequently sending prices sky-high.

Favored Investments

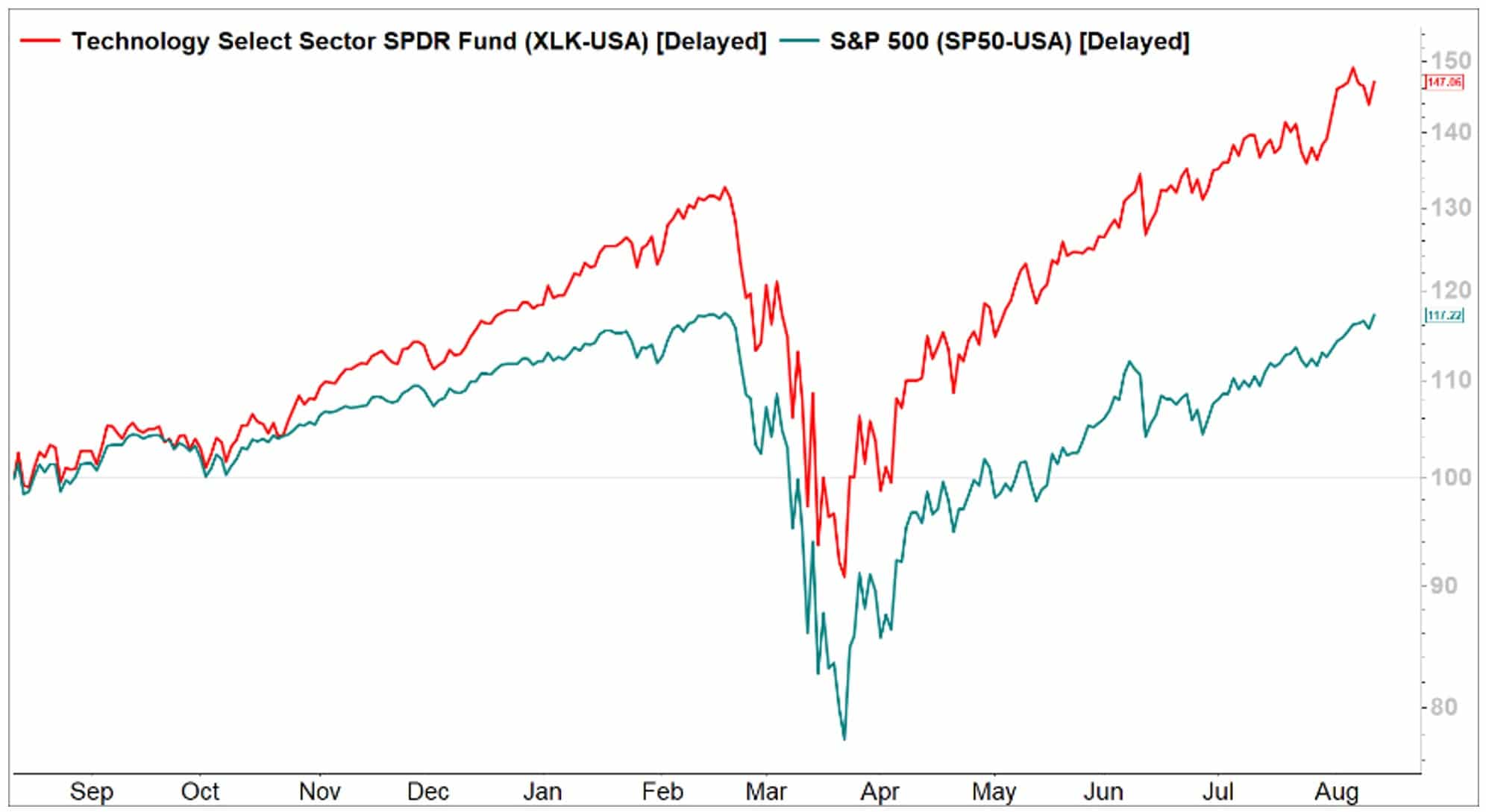

The second and third quarters of 2020 have seen tremendous growth in specific technology stocks and companies that benefit from the “stay at home economy”. Interestingly, technology names often categorized as growth stocks were also seen as defensive positions, as their revenues were not expected to take major shutdown-related losses. For those investors looking for risk, the options for investment seemed to narrow around these themes, pushing the stock price of these companies up far ahead of broader markets and the S&P 500 index.

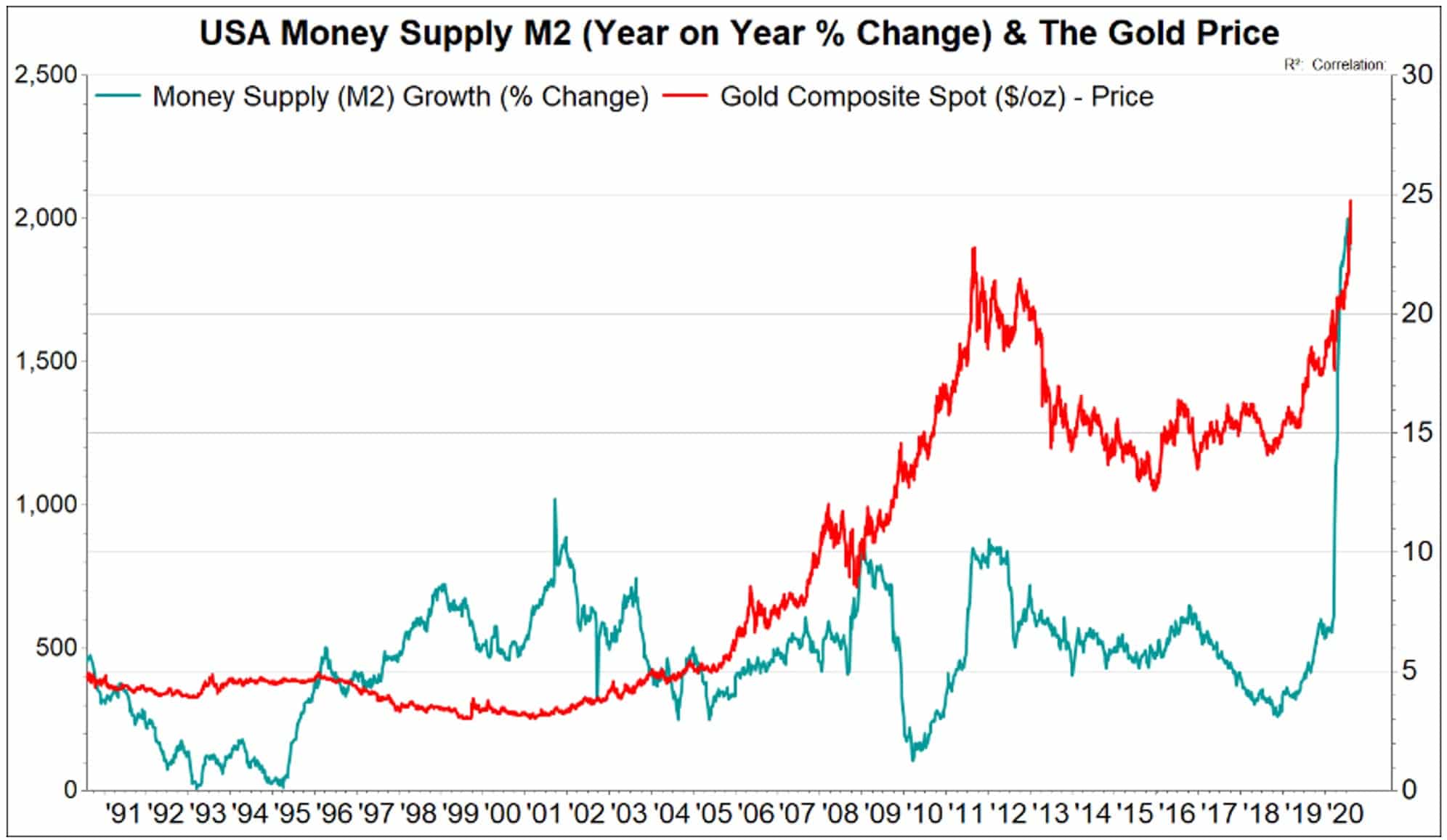

During this same period, for those investors looking to move away from risk,

US Treasuries and Gold became the assets of choice. Fund flows into the treasury market were truly and literally, unprecedented. Bond yields, the inverse of price and therefore decreasing with an increase in buying, plumbed depths never seen before. The current yield on the 10-year treasury sits at just over .6% vs. 1.74% a year ago. That’s nearly a 300% decrease. Gold, another asset class that benefits during times of uncertainty, has also experienced explosive growth. Coupled with negative real-rates in the treasury market and concerns over stimulus induced inflation, at 2000 dollars an ounce, the price of gold has increased 36% year-to-date.

Why is rotation risk so concerning at present?

While sector (various industries that make-up the market) and asset class rotation are to be expected as we move through the various stages of every economic cycle, investors and money managers need to be particularly cautious during these times. The strange features accompanying this extremely fast fall into recession, extraordinary monetary and physical measures utilized to stem the economic fallout from the shutdowns, and the potential for a vaccine-driven rapid rebound in the economy (and risk appetite) could create the perfect setup for very quick rotations. We’ve seen some evidence of this pattern over the past couple of months, when positive vaccine news has caused selling in technology favorites and “stay-at-home economy” names…and buying in what has been termed the “reopen” trade. The relatively low valuations and perceived value in out of favor sectors like Travel and Leisure, Financials, and even Energy may quickly become choice bets catching investors off-guard.

Equally as concerning is the turmoil that is likely to ensue in the bond market and gold trade. With the broad-sweeping confidence in risk assets ushered in by a successful vaccine and effective therapeutics, money flowing out of the safety of treasuries would cause yields to shoot upward, leaving those with multi-year, low yielding bonds in a tough position. Likewise, inasmuch as gold prices were driven up by economic uncertainty and low-yielding treasuries, they could easily and suddenly reverse course, giving back much of this year’s gains and punishing those that purchased the precious metal at such an inflated state.

At Renaissance

The atypical nature of this recession and likely equally strange recovery, has created a particularly challenging time for investors and money managers. There have been opportunities to benefit from these volatile markets and plenty of occasions to experience substantial losses. At Renaissance, we continue to believe that balanced portfolios, disciplined investing for the long-term, strong fundamentals, and careful analyses of macroeconomic conditions is most effective. As active investors, we are continually monitoring our portfolios and making investment decisions to minimize risks such as rotation risk for our clients.

Please call us anytime if you’d like to discuss markets, your investments, or any financial planning concerns that are weighing on your mind.

Written by:

Christopher A. Silipigno, Chartered Financial Consultant® (ChFC®)

Chief Operating Officer and Managing Director

This article is limited to the dissemination of general information pertaining to Renaissance’s investment advisory services. It is for informational purposes only and should not be construed by a consumer and/or prospective client as a solicitation to effect, or attempt to effect transactions in securities, or the rendering of personalized investment advice for compensation. Renaissance’s specific advice is given only within the context of our contractual agreements with each client. Advice may only be rendered after delivery of Form ADV Part 2, Form CRS and the execution of an agreement by the client and Renaissance